Recently, JinkoSolar Energy Holdings Co., Ltd. (hereinafter referred to as “Jinkee Energyâ€) announced the financial report for the second quarter of 2013. The financial report data shows that the company’s operating margins and net income have recovered positively for the first time in more than a year, and the revenue is relatively low. Last year increased by 43% to 288 million US dollars. Became the first PV company to achieve profitability.

Recently, JinkoSolar Energy Holdings Co., Ltd. (hereinafter referred to as “Jinkee Energyâ€) announced the financial report for the second quarter of 2013. The financial report data shows that the company’s operating margins and net income have recovered positively for the first time in more than a year, and the revenue is relatively low. Last year increased by 43% to 288 million US dollars. Became the first PV company to achieve profitability. Turning losses into profit in the second quarter

JinkoSolar’s ​​total revenue for the second quarter of 2013 was 1.76 billion yuan, a 51.7% increase from the first quarter of 2013, a 42.6% increase from the second quarter of 2012, and a net profit of 49 million yuan. The quarterly net loss was 128.7 million yuan. In the second quarter of 2012, the net loss was 310.5 million yuan. The company's integrated gross profit margin from silicon wafers, solar cells, and solar modules was 18.3%, compared to 13.1% in the first quarter of 2013 and 11.2% in the second quarter of 2012.

Data show that during the period, the company's total shipments of solar energy products were 489.2MW, including 460.0MW solar modules, 11.1MW silicon wafers, and 18.1MW solar cells. Compared with 338.6MW in the first quarter of 2013, it increased by 44.5%, which is an increase of 61.9% compared to 302.1MW in the second quarter of 2012.

It is understood that Jingke Energy had a net loss of 128.7 million yuan in the first quarter of this year and a net loss of 310.5 million yuan in the second quarter of last year. For the second quarter loss, Jing Ke Energy CEO Chen Kangping said that since the third quarter of 2011, the company achieved profit in the first quarter. This is mainly due to the fact that the management quickly responded to many fundamental changes in the market and responded to a more favorable industrial situation. In particular, in the emerging markets where the company's strategic layout was placed, during the reporting period, the company gradually reduced its reliance on the European market and achieved more results in emerging markets.

“These fundamental changes have been further supported by a series of good news from both domestic and international sources. The EU and the Chinese government have already reached a mediation agreement on the export of photovoltaic modules, which has improved our visibility to the European market. Recently, the program issued by the State Council of China has been published. The sex document emphasized the strategic importance of the photovoltaic industry and set a clear goal of achieving 35 GW in 2015."

Orders have been scheduled for October to be strong growth in 2013

It is understood that in the past few quarters, JinkoSolar has increased its annual production capacity of silicon wafers, photovoltaic cells and modules from 1.2GW to 1.5GW through technological improvements and product line upgrades.

JinkoSolar executives revealed that the total cost of manufacturing PV modules will be reduced to US$0.50 per watt in the future, including the cost of US$0.09 per watt of silicon. This means that the decline in the past three quarters reached $0.09, which is undoubtedly benefiting from 100% capacity utilization. The company stressed that cost reduction projects include the cost of falling silicon.

According to an analyst from Raymond James, Jingke Energy is an exception and it is almost impossible for other professional Chinese PV companies to make profits in the second quarter.

The financial report shows that in the second quarter, the company built three utility-scale PV projects in China, with a total installed capacity of 55MW and there are 146MW photovoltaic projects under construction. It is estimated that by the end of 2013, 200-300MW photovoltaic power plants will be built. The company also expects that the current strong sales situation will continue until the third quarter of 2013. It is expected that module shipments will reach 460-500 MW. For the whole year of 2013, JinkoSolar expects PV module shipments will reach 1.5-1.7GW, and maintain profitability.

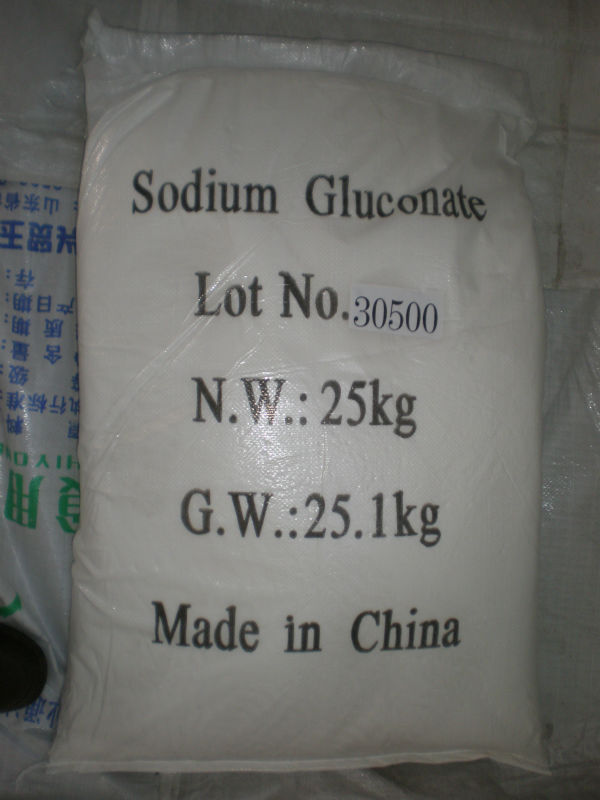

Molecular formula: C6H11O7Na

Molecular weight: 218.14

Properties: white crystalline granule or powder, easy to dissolve in the water

Standard:

Quality standard

Item standard

Industry grade: food grade

Identification in: accordance with standard

Assay: ≥98.0%, 98.0 - 102.0%

Loss on dry: ≤0.50%; ≤0.30%

Reduzate: ≤0.70%; ≤0.50%

pH: 6.2 - 7.8; 6.2 -7.8

Sulfate: ≤0.05%; ≤0.05%

Chloride: ≤0.07; ≤0.07

Pb: ≤2μg/g; ≤1μg/g

Arsenic salt: ≤2μg/g; ≤2μg/g

Heavy metals: ≤10μg/g; ≤10μg/g

Appearance of solution (1.0g, 10ml water): colorless, almost clear

Usage:

1, In the medicine field, it can keep the balance of acid and alkali in the human body, and recover the normal operation of nerve. It can be used in the prevention and cure of syndrome for low sodium. In this purpose, it also can be used as Food Additives

2, It can be used as water quality stabilizer because it has excellent inhibiting capacity to scale

3, Used as surface cleaning agent of metal

4, Used as cleaning agent of glass bottle

5, It also can be used as water reducing agent and retarder in the building industry

Packing: 25kg in plastic film bag lined plastic woven bag, or following your demand

Sodium Gluconate,Nano Silica,Concrete Retarders Sodium Gluconate,Construction Chemical 99% Sodium Gluconate

Shandong Tiancheng Chemical Co., Ltd. , http://www.akdchemical.nl

![<?echo $_SERVER['SERVER_NAME'];?>](/template/twentyseventeen/skin/images/header.jpg)